By the end of this article, you will have your tax card ready.

Tax card is one of the most important things that you need to consider seriously. If you get a job or you want to start a job, the employer will ask at least two of things:

- Valid residence permit

- Tax card

In Finland, no matter where you want to work (restaurant, university, office, or in any other companies), you must have to have a tax card. I am emphasising it too much because if you do not have a tax card, then there are chances that you will be in trouble in future. I understand you might be a bit scared. Or you might be coming from a country (like me) where it is a lot of hassle to get a tax card.

In Finland, it is as easy as daylight. Oh sorry, I think daylight is not easy here in Finland but anyway. It is just a matter of 5 minutes and you can do it from your bed. I have 9 steps here, but trust me, in most of the steps, you do not even need to do anything.

I will explain it step-by-step so that you can follow them to get your tax card.

Step 1:

First thing you need to get a tax card is a bank account in Finland. I will write a separate blog about the banks in Finland, but, literally you can choose any bank that operates in Finland. After opening a bank account, you will get login credentials for online banking. For example, I opened my first account in Nordea Bank and I received a personal code of 8 digit with which I could login in online banking.

Step 2:

Now, let’s consider you already have a bank account and login credentials. Second step is you will visit “www.vero.fi”. Then click on “My Tax” or in Finnish “Oma Vero”. Then click on “Login to my tax card” or in Finnish “Kirjaudu Omaveroon”. Then login with your bank credentials.

Step 3:

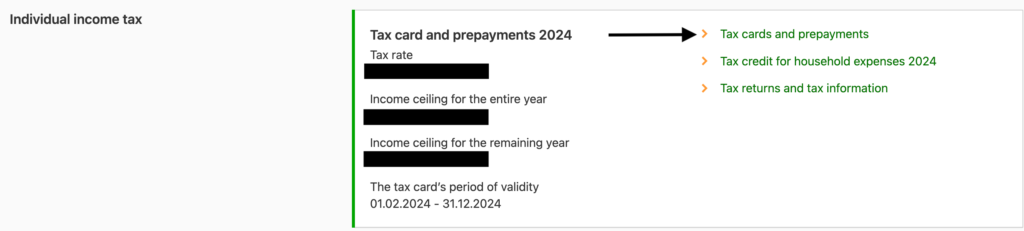

Check the section of individual income tax. Click on “Tax card and Prepayments”, then click on “Request a new tax card” and then choose “Select the short tax card request”. As this is your first tax card, a short tax card will be more than enough. I never needed a long tax card yet.

Step 4:

Now you need to fill up some information. You will not need to change anything in the “Background” section. So you should move to the next step.

Step 5:

In the “Pre-completed income and deductions (short tax card request)” section, you need to select the method of reporting income received as “I am submitting up to date information”. Now you need to make an “approximate” estimation for the income of the entire year. For example, if you are supposed to earn 10,000 euro in a year, insert that number. If you are aware about the fact that you will get some benefit from the government (i.e., Kela benefit), insert information about that. Otherwise leave this field empty.

Step 6:

If you are receiving any study grant then give that information in the “Other income” section, otherwise, proceed to the next step.

Step 7:

You do not need to worry about the “Other deductions” section if this is your first tax card. If this is not your first tax card, then you need to give information about your travel expenses and/or your labor market organization’s payments (i.e., PAM, STTK etc.).

Step 8:

In the delivery method, select “Only in MyTax”. This will automatically generate your tax card in a few moments.

Step 9:

In the “Preview and submit” section, check all the information and press “Submit”.

Your TAX Card is ready NOW!

Go to the homepage, and then click on “Tax card and Prepayments”. Scroll down and click on “Open Tax Card”.

Just send this pdf tax card to your employer. You are Done.